Thaynná Bastos went viral sharing jackpot updates; understand what happened and discover suggestions to avoid falling into “traps”

Reach the end of burnt pushed Thaynná Bastos, 28, from Rio de Janeiro, to decide to resign in the middle of the pandemic. She mei – Individual micro-entrepreneur -, she found herself without unemployment benefits, with little money and chose not to pay her Nubank credit card bill anymore so as not to find herself “broke” if she didn’t find a new job . This happened three and a half years ago and now a negative debt of R$5,000 has turned into R$1 million.

Receive the main news directly on WhatsApp! Subscribe to the Terra channel

In an interview with Earth, explained that the first installment he didn’t pay was in November 2020, when he left his job. The bill costs around R$1,500. However, in December she admits that she spent more on the card, as she still had a usage limit. Until, at the end of the year, she lost the physical card and left the account aside.

The scare came when, in January 2021, Thaynná opened the bank app and came across a debt of R$5,334 thousand, with interest and a fine. In an attempt to “ignore” the accusation, considering herself a “financial layperson”, she ended up canceling the bank’s request. But there was no way, because the debt continued to run and the ‘monsters’ continued to haunt her via email. It went on like this until a year later, in January 2022, he already had more than R$28,000. for ‘the purple one’.

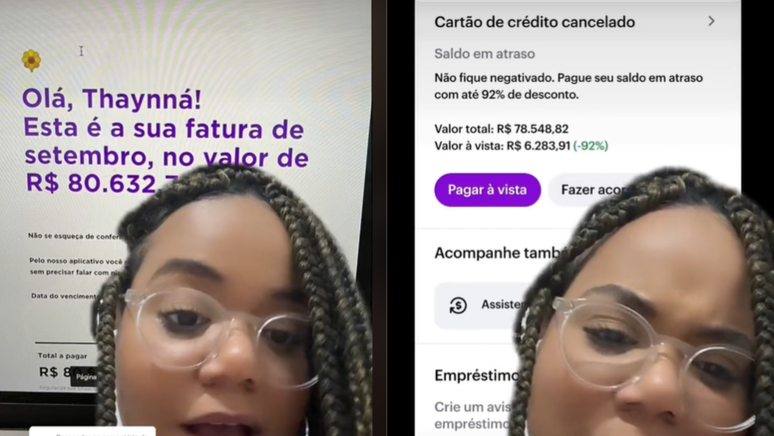

“Every month I went to look at the bill and it was always an exorbitant, absurd amount,” he said. Then, like a snowball, she saw her debt go up in smoke R $ 53 thousand in June 2022, R $ 70 thousand in August and R $ 80 thousand in September… Until he decided to look for ways to renegotiate, for the first time.

Upon entering the renegotiation section of the application itself, two options appeared: pay R$78,500 in installments or, with a “92% discount”, pay R$6,200 in cash. She didn’t renegotiate, because she says she couldn’t afford this deal—and the debt continued to grow exponentially, month after month, with interest upon interest.

Initially she admits to feeling desperate. But she decided it would be better to “laugh than cry” and she shared this mess on her TikTok profile. The video showing her invoices went viral and she began to be accompanied by a legion of ‘endivors’, as she jokes, who from time to time, curious, ask her to update them on the progress of the debt.

Until March she returned to her profile, “on request”, to reveal how much the amount was and it went viral again. This time, step by step, the invoice closed at R$968,800. At the end of the month, he updated that the value has already exceeded R$ 1 million.

@thathawho The day @nubank put me in debt because I was 5K in debt in November 2021. 😂 #fy #foryou #foryoupage ♬ original sound – Thaynná Bastos

To the EarthHenrique Castro, a finance professor at the São Paulo School of Economics of the Fundação Getúlio Vargas (FGV), explained that credit card interest is charged when you don’t pay your bill in full by the due date. Regarding the amount not paid when due, interest accrues.

The median rate among banks, analyzing data from the Central Bank of Brazil, is around 15% per month. In a report, referring to the period from February to March this year, Nubank appears with interest rates of 12.54% per month and 312.62% per year.

“The variations between institutions are quite large. There are institutions that charge up to 22.94% per month for this type of debt,” explains Castro.

In the event of a penalty for late payment, up to 2% of the amount of the installment can be charged, as required by the Defense Code.

To put a “ceiling” on these expenses, In cases of credit card debt incurred after January 3 of this year, new rules come into force that limit revolving interest to 100% of the original value of the debt. Therefore, for example, a debt of R$5,000, with interest on interest, cannot cost more than R$10,000.

However, for debts incurred before this date, revolving interest continues to be charged in accordance with the contract signed between the customer and the bank, as in the case of Thaynná.

“Difficult Choices”

Thaynná shares her story in a comedic way and makes many laugh at the situation. But, with the visibility she has gained on the internet, she also receives negative comments that affect her anxiety. In this love-hate relationship with the show, she says she ultimately had to step away from social media for a while to deal with the situation.

“There were people who said that if they had a debt of that magnitude they would not be able to sleep, that they would sell their house, their things, but that they would not be left with such a debt… Guys, for the love of God. I live in Brazil, in Rio de Janeiro… I’m not rich, I’m not an heiress, I live in a community. We have to make difficult choices in life. If this were all my problem, I think I would gain from it,” she believes.

Now, revisiting the situation, there is a possibility to renegotiate your debt in Feirão do Serasa. The proposal, which showed the Earth, is that R$52,750 is paid in cash or in a maximum of 25 installments. For her it’s still a lot of money.

Thaynná says he has not received any direct contact from the bank seeking agreements and also admits that he has not sought them again. What he will do, therefore, will be to continue to follow the matter with a lawyer in search of values that he considers more fair, but Your goal is to pay what you owe.

The Report contacted Nubank about the case, which said it “does not comment on specific cases.” It also specifies that it is available to the customer on its official channels for the renegotiation of the debt.

“Every customer can speak to us by telephone or via platforms such as Serasa Limpa Name and Convention Certo to resolve outstanding debts, accessing affiliated options that provide discounts. The company also creates and participates in campaigns offering offers whose discounts can currently be around 98% of the amount due, according to criteria and analysis on a case-by-case basis. Nubank also recommends customers try to renegotiate their debts as soon as possible, avoiding the impact of interest on interest,” the company added.

Priority

In addition to this million dollar debt, Thaynná considers herself a financially conscious person. “I would never make a decision like that if I didn’t really need to,” he stresses.

She managed to re-enter the job market, still as MEI. On the other cards, which he continues to use, he says to avoid paying high-value installments, to keep a low limit and to also try to maintain an emergency reserve, so that if something happens, he will be able to pay off any new one debt immediately.

She is a designer and runs the house with her mother, who is retired. Her brother, who recently finished high school, also lives with them in Morro Andaraí, in Tijuca. When asked what she would do today if she had just over R$50,000 in hand, she didn’t hesitate to answer: she would make a deposit on her house.

“Im 28. For me sometimes the dream of a house seems impossible, you know. Learning to drive, having a car… So I think if I had that money, I would put a down payment on a house.”

How to avoid falling into “traps”

The finance professor of the São Paulo Faculty of Economics of the Fundação Getúlio Vargas (FGV), Henrique Castro, listed five important precautions to take when dealing with credit cards. Discover expert advice:

1. Control your expenses

Write down all your purchases, set a budget, and compare it to your actual expenses. Set a personal spending limit that is lower than the limit available on your card. Avoid impulse purchases, wait 24 hours before making non-essential purchases.

2. Invoice and payment

Pay the bill in full: Avoid high and revolving interest. Pay attention to the due date, avoid delays and minimum payments. Dispute improper charges and contact your bank to resolve issues.

3. Security

Keep your data in a safe place, do not share your password or card details with anyone. Be careful of scams, be wary of very advantageous offers and check the security of the site before buying online. Use the card carefully, avoid using it in suspicious places or with tampered with machines.

4. Rates and Commissions

Choose the card with the lowest annual fees, interest and other fees. Negotiate fees, talk to the bank to reduce or eliminate very high fees. Keep an eye out for promotions, take advantage of free annual subscription offers or other benefits.

5. Consciousness

Consider conscious use of credit: the card is not an extension of your income. Prioritize paying in cash, avoid compromising your future income with debt. Seek financial education, learn to manage your assets and use your card wisely.

Income Tax 2024: Experts Answer Questions About MEI Filing and Small Businesses

Did you know that a small mistake you make when filling out your tax return can cause you to pay more taxes than you should? To help resolve the countless doubts that arise at the time of the tax return, Terra promotes, this Friday (22/03), at 11 am, a live broadcast with experts to answer questions on the MEI declaration, on small businesses and on small businesses . Follow the broadcast on the Terra home page or on the portal’s YouTube channel. You will be able to answer your questions live. Click here to watch the live broadcast.

Source: Terra

Ashley is a professional author and journalist, working at 247 News Update. She writes on various topics from economy news to general interest pieces, providing readers with relevant and informative content. She brings a unique perspective and in-depth analysis to her work.